Employer payroll tax calculator georgia

Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. Ad Compare This Years Top 5 Free Payroll Software.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Ad Process Payroll Faster Easier With ADP Payroll.

. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Process Payroll Faster Easier With ADP Payroll. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Georgia payroll calculators Latest insights The Peach State has a progressive income tax system with income tax rates similar to the national average. Get Started With ADP Payroll.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Compare This Years Top 5 Free Payroll Software. Higher earners pay higher rates although Georgias brackets top.

The standard FUTA tax rate is 6 so your. Georgia requires employersexcept those in the farming sawmill and turpentine industriesto pay all employees all wages due on paydays selected by the employer. Discover ADP Payroll Benefits Insurance Time Talent HR More.

With six diverse tax brackets salaries in Georgia is especially progressive psychological. Ad Get the Payroll Tools your competitors are already using - Start Now. Select your current state from the checklist below to find out the hourly paycheck loan calculator.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck. Free Unbiased Reviews Top Picks. The following is a list of payroll-related taxes required for businesses in the state of Georgia.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax rates. GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. After a few seconds you will be provided with a full breakdown.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Social Security 62 Medicare 145 Federal Unemployment Insurance FUTA 06. This includes tax withheld from.

The maximum an employee will pay in 2022 is 911400. Ad Find out if you qualify for the ERTC Program. Use the Georgia paycheck calculators to.

Free Unbiased Reviews Top Picks. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Find out if you qualify for an ERTC Tax Credit.

The calculator includes options for estimating Federal Social Security. Determine withholdings and deductions for your employees in any state with Incfiles simple payroll tax calculator. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Get Started With ADP Payroll.

Payroll Tax Calculator For Employers Gusto

State W 4 Form Detailed Withholding Forms By State Chart

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Employer Payroll Tax Calculator Incfile Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

Employer Payroll Tax Calculator How To Calculate Withholding Tax

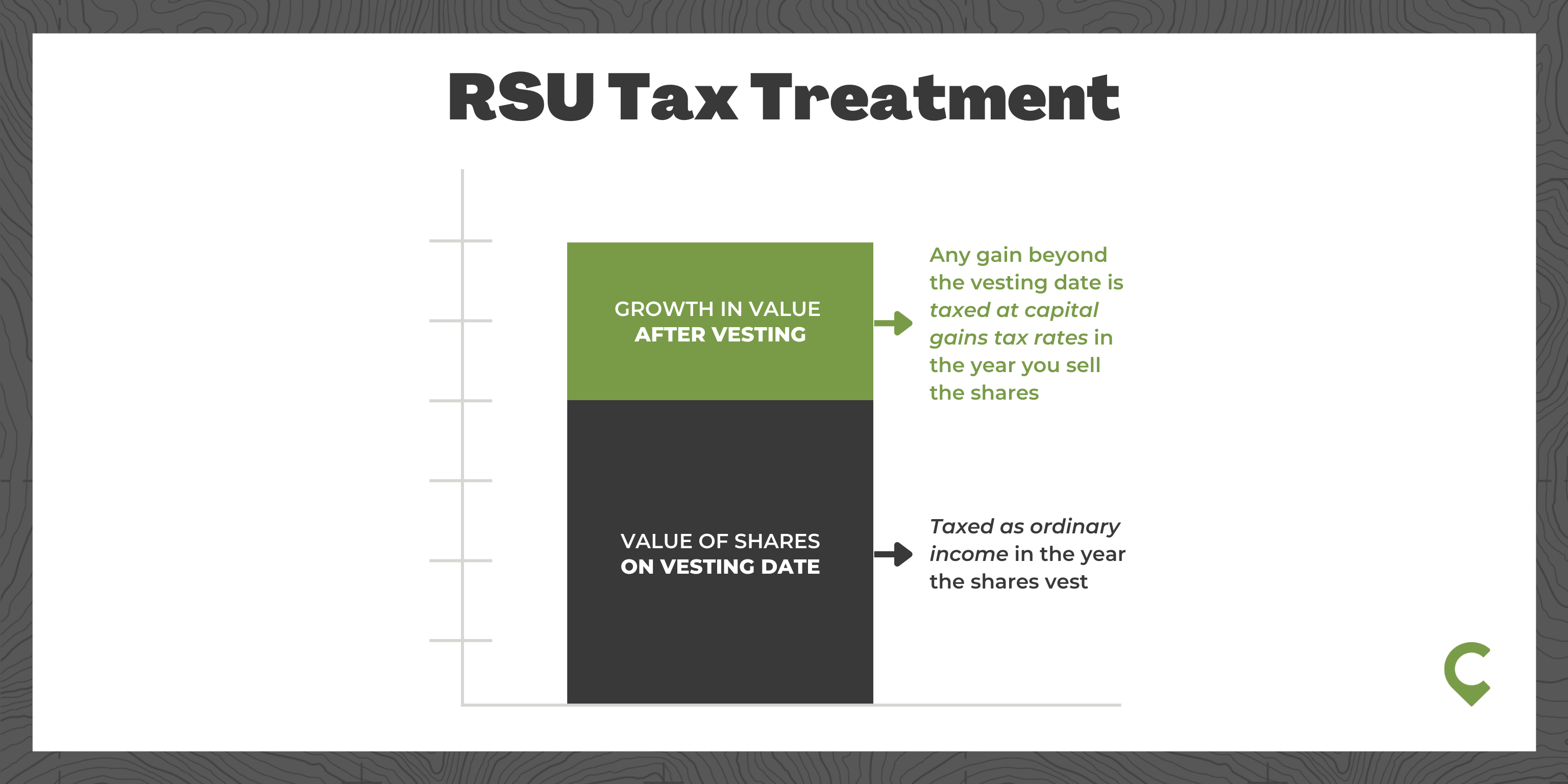

Rsu Taxes Explained 4 Tax Strategies For 2022

![]()

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

![]()

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Georgia Paycheck Calculator Smartasset

A Beginner S Guide To Protecting Your Business No Matter Where It Operates From Home Office Expenses Being A Landlord Small Business Tax Deductions

Payroll Tax Calculator For Employers Gusto

2022 Federal State Payroll Tax Rates For Employers